Budgeting with Your Kids

Budgeting can be boring and tedious, but it’s something that creates wealth and pays off down the road. So how do you get kids excited about it? How can you add a little glamour to something so dull and boring? Easy – make it a game with payoffs. If you have a budget, and you allocate yourself a spending amount for your shopping adventure – this will help you to really consider your purchases!

Teaching your kid budgeting skills will help them learn a lot about managing money. Give them a shopping budget for toys and let them decide what they want to buy within that budget. This is the ideal way to get them to distinguish between needs and wants. For the slightly older kids, you can let them calculate your bills such as mortgage payments, phone bills, utility bills, their tuition fees and other expenses, and explain how you go about them.

This is an ideal way to help them achieve financial literacy. At the center of any good money management program is the capacity to differentiate between wants and needs. This realization will help build the groundwork for managing finances as an adult.

Brand Names Do Not Always Mean Better – Reinforce that it’s not always beneficial to shop by brands. At the grocery store illustrate that generic products can save significant amounts of money for people on a budget.

Show your children how much things cost – Many times kids don’t understand what things cost because they don’t have to pay for it. Even as adults we do the same thing. Do you ever notice how you spend differently when you are spending other people’s money? Your children should be aware of the price things cost. The next time your child asks you for something use it as a way to teach your kid about money. Don’t just buy it but have them make a list of the items and then have them find the price of those items. The internet makes this a very easy process and if need be, take them to the local store.

Figure out how to pay for it – Once your child understands the cost of an item then you need them to help figure out how they will pay for it. Obviously, you could just give them the money, but we are looking for a higher objective here which is teaching your kids about money. If they are too young to work, then find additional chores to do in the house as a means of earning the money. The chores should be outside of what they normally do, this way they understand that what they are doing is work and not just getting paid for their regular responsibilities.

Make a list – Think about what it is you want to purchase before you hit the shops! This will keep you on track and help to avoid distractions like bargain tables and bins. I find it especially useful when grocery shopping, as this is a place where it is incredibly easy to make impulse purchases, particularly in the sweets isle.

Assess the options

If you do find yourself in a situation where you’ve been presented with an unexpected bargain, make sure you compare items for price and quality. Ask yourself the question “Can you get it somewhere else, cheaper perhaps?”

Above all, take the time to think about the purchase. If you have any doubts, then perhaps it’s not a wise purchase. Consider sleeping on it, as it will always be there tomorrow.

Get them involved in things like budgeting for their monthly expenses or even a vacation plan. Make them add up their allowance for the month and work towards saving an amount every month. Once they note down their expenses, they will soon realize whether they made a wise decision or not. Of course, depending on their age you will need to guide them through the process. The idea is to make their allowance a teaching tool for their finances.

Your children may learn a lot from watching you doing the work, but nothing beats first-hand real-life experience in teaching kids money management skills. When you feel they are ready, let the kids manage their own budgets. They will become money savvy quicker learning from their own mistakes.

Another good idea would be to include your children in the budgeting process. You can sit down with your children and actually plan the budget for the month. If you really want to have fun, have them do the budget first without your input. Give them the categories and how much money you make and see how they would divide the money. Once they have done that then you can use that as a guide and make your actual budget. It’s important when planning your budget that you include everything you spend money on. So, include things like entertainment, saving, even allowances for your children.

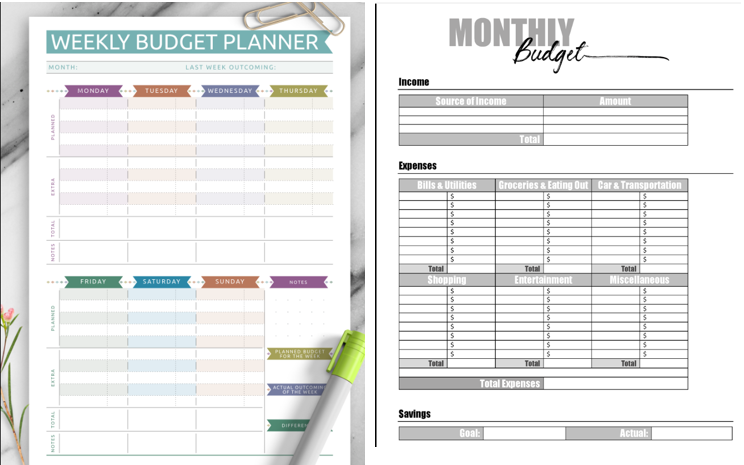

Pre-teens and teens can make a real household budget with you for one month. There are tons of free templates online to use. Fill-out the worksheet with your income and all of your fixed expenses (insurance, car payments, property taxes, etc.) and have kids look at your disposable income to determine what will be needed to cover groceries, clothing, entertainment, subscriptions and the like.

Once everything is divided up, check in with your children daily to see how the budget is looking. If they want to do a family activity and there’s no money left in entertainment, have them decide where they will take the money from and if it’s even possible to do the activity that month. Sit back and watch how they resolve the situation!

Talk to your child about the family budget. Allow them to ask questions about household finances and how you manage the household budget. Reinforce the learning process by budgeting for a family outing or a purchase.

In addition to this budgeting helps kids keep track of their money. It shows them the importance of knowing where their money is going. Have them keep track of their money in a notebook or on the computer. You can even make a file where they can organize and store receipts and bank statements.

Creating a Budget

You may have your own way to create a budget, and that’s fine. In my experience, the easiest way to make a budget is as follows:

Divide a piece of paper into two by drawing a vertical line in the middle;

- Spending Budget – Calculate your average monthly gross income and put that at the top of the page, then multiply it by 0.8 (for example, if you earned $1,000, you would end up with $800)

- Fixed Expenses – Write down all of your FIXED expense categories (i.e., phone bill, insurance, mortgage etc…) and put them in one column on the left side of the page.

- Variable Expenses – Next write in the variable expense categories (i.e., food, gas, leisure, etc…) and put them in another column on the right side of the page.

- Fill in all of your expenses.

- Net Budget after Fixed Expenses – Subtract fixed expenses from your spending budget. If it’s a positive number, you don’t need to change anything If it’s zero or a negative number, you should look for expenses that you can cut or lower.

- Budget variable expenses – Using your Net Budget after fixed expenses, determine what you can spend on variable expenses without overspending each month.

- Set a budget for each variable expense so you know what you can spend on each category in a given month.

6 Tips for teaching your kids about budgeting

i) Making it Fun

When you want to teach your kids about managing finances, don’t give them a lecture, or else they may space out and get distracted by other things. For younger kids, look for story books that teach lessons involving money and that have illustrations that your kids can appreciate. For older kids, buy them entertaining but easy-to-read financial literacy books.

OK, now that you have a budget outline, it’s time to get the kids excited. I know what you’re thinking: “My kids will never be excited for this.”

They will if you give them some prizes or payoffs. Here’s how:

First, tell them what a budget is and show them the paper. Next, tell them that you’re going to do a contest (You can adopt this if you have more than one kid).

Contest 1: Anticipating Spending

The first contest is to see how close they can budget their money to reach a break-even or $0 over the course of a month. In other words, the goal is to predict your spending as close to the penny as possible.

If you have more than one kid, the one that gets the closest to break-even without going negative wins a prize. With just one kid, tell them that they get $5 or $10 if they reach break-even, and every penny they are off, you deduct.

Contest 2 – Saving After Spending

The second contest is to see how well they can budget their money over the next 30 days. If they can save money, tell them you will give them whatever they save. That means if they save $5, you’ll give them another $5 (just like companies matching a person’s 401K contribution).

If you have more than one kid, tell them whoever is able to save the most will win and get a special prize. You will obviously choose the prize since you know your kids best.

ii) Ask Them to Participate

When out shopping, you can help your kids learn the importance of budgeting by asking them to help you out. For example, before you grab a jar of peanut butter, ask your child to read the prices of various peanut butter jars and choose the one that has the lowest price. You can also ask for their help with finding and clipping coupons that your family can use, coming up with a family budget, and searching for the best travel deals and hotel rates if you plan to go on vacation.

iii) Let Them Get a Part-time Job

Once your children are old enough and they have some free time from school and other responsibilities, you can encourage them to take on some part-time work. Not only will earning money from work motivate them to better manage their finances but working will also help them learn how to manage their time.

iv) Give Them a Way to Save Their Money

If your kids are still young, you can give them a piggy bank to save their money in. Once they are older, help them open their own savings account. Having a place to save their money can encourage your kids to save more often.

v) Create Your Budget with Them

When creating a budget, let your kids join you so you can explain why you need to set aside a fixed amount for your necessities and why you have short-term and long-term savings accounts. You should also let them join you when you view your credit reports and review your debts so you can explain how important it is to have a good credit history and to practice smart financial habits.

vi) Impose Limits

Remember that if your kids use their weekly allowance up before the weekends, do not be too quick to bail them out-especially if it isn’t the first time that they have asked you for more money. It is very important for your kids to experience the consequences of their choices, especially while living under your roof. Additionally, avoid buying your kids everything that they want. Let them think about whether they actually need it or they just want it. If they just want it, encourage them to work for it so they will learn the importance of making choices when it comes to budgeting.

Teaching kids about budgeting can be difficult, which is why it is very important to start early on. By getting an early start, there is room for your kids to learn from their mistakes, and any mistakes that they might make are minimal.